- #Turbotax s corp software how to#

- #Turbotax s corp software software#

- #Turbotax s corp software professional#

- #Turbotax s corp software download#

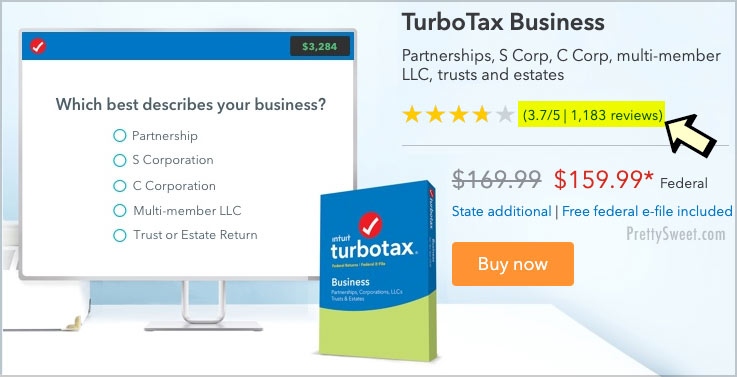

Otherwise, basic scenarios like owning a home or investments can become very expensive to purchase.

#Turbotax s corp software download#

You can download TaxAct software, but the program is also available in an online format that allows you to save more money, so we suggest starting with that option. Think of TaxAct as a simplified version of the TurboTax format that may be more suited to people who have been using tax programs for a while and don’t need so much handholding. TaxAct (once Ta圎dge) takes you through your Life Events in the past year, and then walks you through how these events affect your state and income taxes, giving you the information you need to fill out the appropriate forms (although it won’t autofill everything for you).

#Turbotax s corp software software#

TaxAct Best tax software for experienced customers Keep an eye on extra charges for state filing though, as this is where H&R Block really raises the fees. There are still plenty of online help and chat services, but it’s nice to have the option to make a real-world appointment if you want to. Their primary tax program, however, is very similar to TurboTax, with a friendly interface and question-and-answer format that hides most of the real tax documents until the end.

#Turbotax s corp software how to#

H&R Block’s services span apps, full programs, in-office visits, credit cards, and much more: It’s a nice variety of options if you like choosing how to deal with your taxes, or you need some combination of digital self-filing and tax services to get everything done. H&R Block Best full-service tax prep software Also, TurboTax has some of the highest fees if you have taxes more complex than a basic filing, so be prepared to pay. The interface can get a bit confusing when you are looking directly at your tax forms rather than using the TurboTax question format, which may make it difficult to find a specific form or answer a certain question not covered by the walkthrough. There are a few issues worth noting, however. The software also excels at helping you find deductions and ways to save more money. The question-and-answer format makes filing on your own very easy, and there are online chat rooms with tax experts that you can consult should you run into anything too weird. The TurboTax system is easy to use, offers numerous explanations for all things tax-related, and has strong compatibility with past filings. TurboTax from Intuit remains one of the most popular tax software options, and for good reason.

Starts at $17 for more advanced returns, adds $32 per state. States add $45 each.įree for basic filing. Starts at $40 for premium services beyond simple returnsīest tax software for experienced customersįree for very simple returns. It would have been much easier to prove if I had filed the extension using TurboTax because they have a record of it. A few years ago I sent in the extension and when I filed the completed the return the IRS said I hadn’t filed an extension. My business activity and tax returns for each year are pretty consistent and the question and answer interview alerts you to things you may want to research a little before choosing how to answer the questions.įiling electronically is easy and If you have to file an extension you can do it through the program and have a record that you filed for it.

#Turbotax s corp software professional#

I like the fact that I can pay have the return checked by a professional and also buy audit protection in case I make a mistake. Transferring the data from the previous years return is time saving and helps me not to miss something. I find it easy to use and I like the ability to switch from the interview and check the forms as I go. I’ve been using TurboTax for my Sub-S corporation tax return for the last 4 years.

0 kommentar(er)

0 kommentar(er)